It’s a well-known fact that many high-end watch brands retain or even gain value over time. However, most people assume that affordable brands like Seiko assuredly lose tons of value. In this article, we’ll try to see if that’s true or if there’s actually a buck to make from owning Seiko watches.

First, let’s take a look at 7 iconic Seiko watches and how they performed financially in the last decade.

Important info for our calculations

- We used the earliest “Sold by Amazon” prices available on camelcamelcamel.com for the base cost

- We also show the lowest price of the watch (“Sold by Amazon”) since it’s been listed

- We estimate the value of the pre-owned watch in 2021 based on the 10 last eBay sales

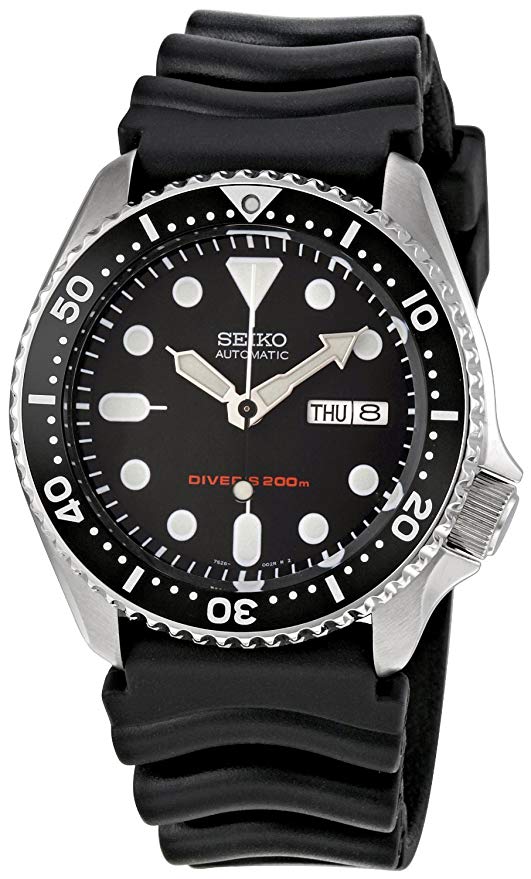

1. Seiko SKX007

| Earliest Amazon Price (2011) | $140 |

| Lowest Amazon Price (2011) | $140 |

| 2021 Sales Average (eBay) | $280 |

| Return on Investment | 7.21% |

| ROI (Lowest Price) | 7.21% |

The first watch I wanted to analyze is probably the most popular in Seiko’s history: the SKX007. This one used to sell for dirt cheap, but prices seem to keep rising to no end these days.

As you can see above, one could buy the SKX007k (Singapore/Malaysian version) for $140 from Amazon back in 2011. The same watch today would sell for around $280 on the pre-owned market, an impressive 7.21% compound return over the last 10 years (better than most bonds)!

However, the price varies a lot ($140 to $375) depending on the condition and origin (Japan-made is more expensive) of the SKX. It’s also good to note that I didn’t include modded SKXs in the sales average, as those usually sell for cheaper.

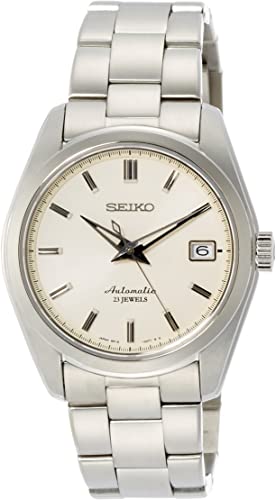

2. Seiko SARB035

| 2012 Price (Amazon) | $500 |

| Lowest Amazon Price (2018) | $320 |

| 2021 Sales Average (eBay) | $493 |

| Return on Investment | -0.16% |

| ROI (Lowest Price) | 15.5% |

Whereas the SKX007 is the king of Seiko dive watches, no one can equal the SARB033/035 when it comes to Seiko dress watches.

This one’s a bit peculiar because Amazon only started selling it in 2018, so I had to rely on third-party sellers for the earlier data. The SARB035 made its entry to Amazon in 2012 around $500. Someone who bought at that price would certainly lose a bit of money when accounting for taxes and maintenance.

However, the price kept steadily dropping thereafter, until 2018, where Amazon themselves started selling it for an astonishingly low figure ($320!!!).

Someone who bought it in 2018 from Amazon and sold it in 2021 would’ve made a mind-boggling 15.5% return on his investment, better than the S&P 500!

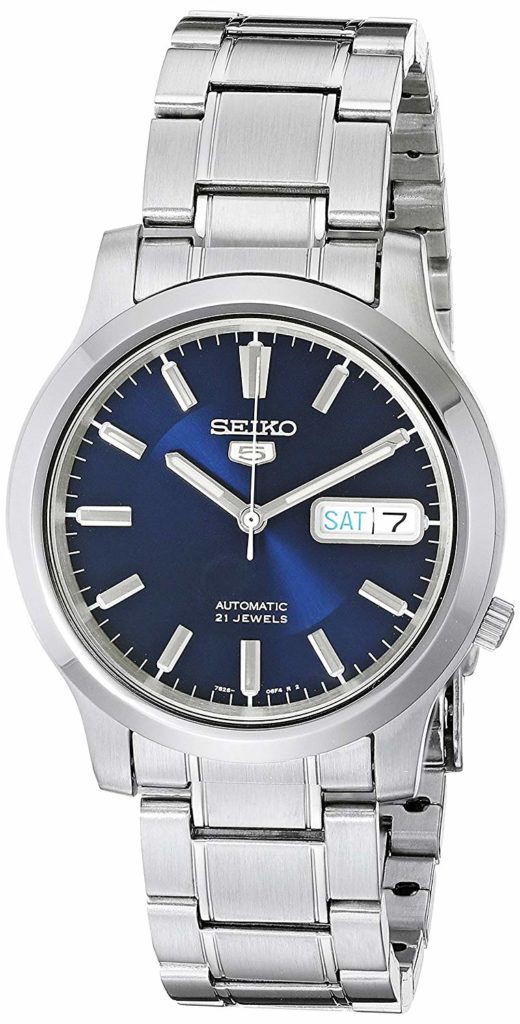

3. Seiko SNK809

| 2010 Price (Amazon) | $90 |

| Lowest Amazon Price (2011) | $42 |

| 2021 Sales Average (eBay) | $80 |

| Return on Investment | -1.04% |

| ROI (Lowest Price) | 13.81% |

The Seiko SNK809 is different from the two first watches because it has been produced in gargantuan numbers. One would think that it would have basically no resale value because of the sheer supply during its production run.

This is true for someone that bought the SNK809 back in 2010 on Amazon. Most of your value would have been eroded by the original sales tax and maintenance (or replacement) of the 7s26 movement.

However, we once again see a great fluctuation of price on Amazon, with the SNK809 reaching an all-time low of 42$ in 2011. This made for a great watch to wear for a decade that you could then sell for a large profit.

It also shows that scarcity and low production numbers aren’t prerequisites for a profitable Seiko watch if you can wait for a great deal.

4. Seiko SNK793

| 2010 Price (Amazon) | $75 |

| Lowest Amazon Price (2010) | $45 |

| 2021 Sales Average (eBay) | $68 |

| Return on Investment | -0.89% |

| ROI (Lowest Price) | 3.82% |

I was truly impressed that the Seiko SNK809 could be a profitable flip, but I wanted to see if it would be the same for a Seiko 5 watch that isn’t as popular.

The Seiko SNK793 definitely has its fan base, but it’s much less in demand than the SNK809. For this reason, there are still plenty of brand new SNK793s for sale even though it was discontinued at the same time as the SNK809.

Obviously, this much larger supply and lower demand affect negatively the resale price. As shown above, most SNK793 buyers would end up with a loss at resale, except if you’re very lucky in finding a good deal. Even then, the margin is basically non-existent after sales taxes and it will take some time to dispose of it.

Also, you’ll have to compete with tons of low-price brand new examples when trying to sell this on eBay.

5. Seiko SGF204

| 2010 Price (Amazon) | $200 |

| Lowest Amazon Price (2011) | $116 |

| 2021 Sales Average (eBay) | $85 |

| Return on Investment | -7.48% |

| ROI (Lowest Price) | -3.06% |

Every watch analyzed up ’til now was powered by a mechanical movement. It’s no secret that automatic Seikos are more desirable than their quartz counterpart, so I wanted to see the difference in resale value.

As you can see above, the Seiko SGF204 was always pretty expensive for a quartz watch. Even at its lowest price, the SGF204 never came close to its 2021 resale value.

Even though it’s pretty popular for its not-so-subtle resemblance to the Rolex Datejust, even people that bought the SGF204 at a “great bargain” still lost plenty of money on it. The only convenience is that you don’t need to service the movement, so a simple $5 battery swap is required before selling it.

Nonetheless, it’s a clear sign that Quartz Seiko watches are (generally) much less desirable on the pre-owned market and should not be considered for value retention.

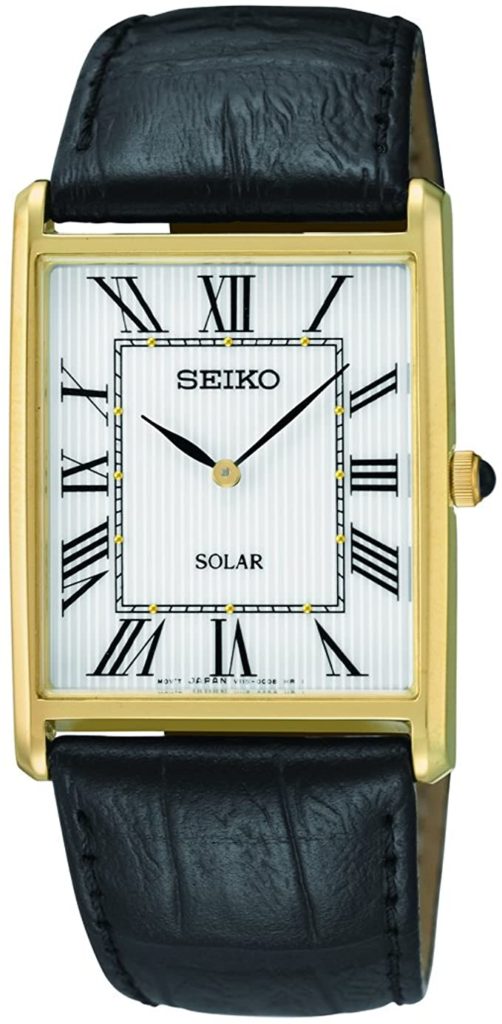

6. Seiko SUP880

| 2014 Price (Amazon) | $130 |

| Lowest Amazon Price (2018) | $79 |

| 2021 Sales Average (eBay) | $80 |

| Return on Investment | -6.70% |

| ROI (Lowest Price) | 0.42% |

A bit earlier we learned that Seiko Quartz watches don’t make good investments, but what about their solar counterparts? The SUP880 is a quirky watch that mixes a solar-powered movement with a styling that’s strongly based on the Cartier Tank.

This one fared a bit better than the aforementioned SGF204, but it’s still not impressive. Dare I say that it only kept a reasonable value because it’s a Cartier Tank homage. 2014 buyers lost quite a bit of money on their purchase, while bargain-seekers barely broke even with the 2018 all-time low.

This shows us that non-mechanical Seiko watches will almost assuredly lose value over time, except for maybe a few iconic homages.

7. Seiko SRPD (5KX)

| 2020 Price (LIW, Jomashop) | $250 |

| Lowest Price (2020) | $220 |

| 2021 Sales Average (eBay) | $152 |

| Return on Investment | -39.20% |

| ROI (Lowest Price) | -30.91% |

I thought it would be unfair to only consider old Seiko models. For this reason, I also studied the price trend of the Seiko SRPD (5KX). This SKX successor was released in early 2020 for a much heftier price than its predecessor.

As with most Seiko watches, the price is quite high on release, gets cheaper with time, and will probably start going up drastically when it gets discontinued. As you can see above, people who bought a Seiko 5KX at release and sold it a year later got absolutely obliterated.

This goes to show that you shouldn’t expect a quick profit (or even value retention) when buying a brand new Seiko watch. Instead, you should wait a few years for the price to bottom, try to find an iconic model, and only sell it a few years after it has been discontinued.

The 5 Commandments of the Seiko speculator

1. Thou shall not modify thy Seiko

If you’re trying to at least maintain the value of your Seiko watch, you shouldn’t mod it in any way. The best example of this is the Seiko SKX, where modded examples are a dime a dozen, but OEM ones are rare like the pope’s excrements.

By modding your watch, not only are you spending extra money on parts that you’ll never recoup, but you’re also removing value from the original watch while making it harder to sell (unless you have very popular tastes).

2. Thou shall take care of thy Seiko

This is probably the most important commandment! Even the rarest, most expensive watch will become worthless if you break it. Even tiny details like scratches on the crystal, rough edges on the case, a worn-out bracelet, etc.. can completely destroy the prospective value of your watch.

This doesn’t mean that you shouldn’t wear it at all, but you might try to wear it only a few times a week. Also, you’ll need to develop “wrist awareness” as to not bang it on doorknobs or not to scratch it on your desk.

3. Thou shall wait for bargains

This commandment is especially true when looking at watches like the Seiko SNK809. An early buyer would’ve overpaid for the SNK809 and ended up with a loss. However, the person that waited for the right time to buy it at the right price would’ve nearly doubled his money.

4. Thou shall hold for the long term

As was demonstrated in this article, many Seiko watches don’t gain value until years after they’ve been discontinued. By selling your Seiko watch too fast, you will potentially miss out on tons of profits.

A long-term hold paired with buying at the right bargain price will make for near-certain value retention when buying a popular Seiko watch.

5. Thou shall not expect a positive return

Although many Seiko watches can appreciate in value if bought at the right price, in no way are they safe investment vehicles. A Seiko should always be first and foremost a watch that you buy because you like it and want to wear it.

Buying a Seiko watch as an investment is pure speculation that will end up burning you in many cases. That being said, there are ways to carefully pick Seiko watches that will most likely end up retaining most, if not all their value.

I hope you guys enjoyed this article! It isn’t a scientific research paper by any stretch of the imagination, but I had a lot of pleasure researching different Seiko watches for the purpose of writing this.

Let me know in the comments below if you’ve successfully flipped a Seiko watch for profit before, or if they all end up losing a big chunk of their value!

Not entirely true.. My Orange monster jumped 4 times in 6 years.

Totally wrong models picked (maybe except the first one). I bought very cheaply 6138/6139 chronographs and also 7A28/7A38 before the collectors craze (more that 10 years ago), and each one of them is selling now at least 2x, upwards to 6-7x sometimes, the original price. You just need to know the (collectors) market. Of course it can change unexpectedly and also I never did this as investment.

How do I research the collectors market

What about the Seiko women quartz diamond collections ? are they worth any?

seiko makes 100 million watches per year you will never make money on a watch that is disposable not only that but the watch company’s mark up there watches by about 20k percent buying any watch is a complete waste of money there in it to win it seiko also makes about 1.5 billion dollars per year

Pingback: Understanding the Resale Value of Seiko Watches | WatchWired.com

Hey people!!!!!

Good mood and good luck to everyone!!!!!

1